Exploring Wealth Management

Howdy friends! I hope you’ve had a beautiful week!

Welcome back to the Infinite Playground.

This week: The highest ratio boring-to-revenue-generating idea I’ve ever had.

No high-concept essay this week.

This Week At Tetra

At Tetra we’re in search of simple, niche, and dominatable markets.

Last week in my post about Fractal Prospecting I shared the idea that niche is a “market you can bear hug”. You can find it’s edges and fit the market in your head.

I’ll add a second variable to my definition of niche: SV tech bro adjacency, or lack thereof. A good niche for Tetra is far from the field of vision of the average Silicon Valley PM or engineer. Competition and funding follow fast on the heels of SV founders. We’re not interested in that. Wherever we play, we want to be the most aggressive and technically advanced player in the room.

I’ve stumbled my way into that exact niche thanks to a conversation at a KC Tech event last week (thanks Patrick): wealth management.

Specifically, regulatory compliance and security for wealth management firms.

Woof. Bored yet? That’s the point.

This is the wealth management “AdvisorTech” market:

This was my Rosetta Stone for understanding what the jobs-to-be-done are in this market and how buyers and sellers talk about them. I now have a springboard for researching the endless financial acronyms, certifications, and legal jargon that a short career stint would’ve taught me. Soon I’ll be study abroad fluent at the broad level - enough for first product research calls.

In the meantime, I had to choose a specific area to narrow in on.

I spent my first couple of days looking at Client Engagement. One of our product pushes at Barracuda centered on owning the engagement layer between DAO core teams and their communities. A lot of very similar tools were used, and I think a similar strategy could pay dividends here. The problem is ACV.

Ideally, I want a business that can extract at least $100/mo of value. Go below that and CAC starts to become a real challenge, and market size becomes a larger constraint. At $100/mo you need 100 customers to pay an average salary of $100k.

Most of the client engagement tools here will be used infrequently (excluding the client portal, potentially). That’ll bias buyers toward the lower ends of pricing tiers. If you’re Jotform selling into this market, for example, I can’t imagine most of the buyers are breaching above their $34/mo tier. That means ~300 customers to pay a salary (and only a $10 allowance to keep a healthy ACV:CAC ratio). This is a healthy place for expansion revenue or a second brand in the future but not a solid foundation for entering this market.

Next, I took my data infrastructure deep dive from last week and started applying what I learned to AdvisorTech. There are a lot of interesting ideas to play with - building a new data warehouse specifically for advisers, or an ETL platform that plugs into all of these tools, etc.

Data infra tools don’t suffer from the same ACV issues as the client engagement stack, but I put them on the back burner. The sense I got from looking at all of these products is that the advisers they serve are smart, but their technical ability may vary widely. An ETL platform would unlock a lot of value, but having engineering teams at these firms seems rare. The more technical the tool, the more time you’d have to spend translating that into dead simple UX. Even nailing that, the problem you’re solving doesn’t cover the whole market.

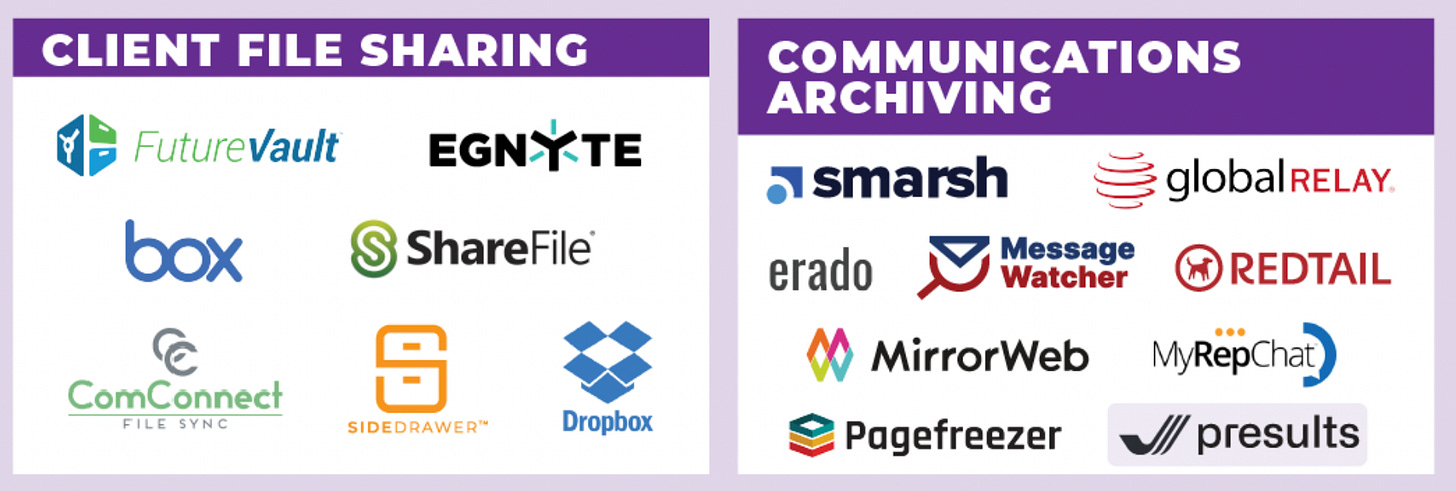

That’s when I found this little nook:

Compliance.

Every firm is legally required to do it. Many firms pay mid-five figures every year to consultants to make sure everything is nice and tidy, or on mock audits/”exams”. There are hard technical problems here, and a bunch of ancient-looking products to help with them. The material is complicated and there are specific Compliance teams who deal with this full-time. That means we have clear buyers with articulated pains and a budget. Ding. Ding. Ding.

There are also extension products around file archival and sharing.

These problems are also security adjacent. They’re both about tracking and influencing employee behavior. Many security problems are also outsourced.

There is a perfect opportunity here for Vanta for X, and that X is compliance.

Here is what I’ve been kicking around:

In a sea of names like “Investorcom”, “ComplianceAlpha” and “SmartRIA”, Buffalo or something similar is memorable and stands out. An icon that is non-intimidating but confident and still mighty, which is how you want to feel about compliance.

The existing compliance products pitch themselves as solutions for “Compliance Management”. Management implies there is a burden that is on the customer that their products help with. Automation implies I’m solving a problem for you, and taking your burden. Compliance Automation creates a category for itself. It’s additive, a new style of solution not directly competing with existing products.

That’s a strong hypothesis to start with. Now I need to talk to compliance teams.

Luckily, I found a break here too.

The SEC shares every registered wealth management firm operating in the United States, as well as the advisers and broker-dealers working at those firms.

These forms contain demographic data that reveal:

Assets under management

Asset allocation

Fee type (tells you roughly how much operating income they have)

Services offered

Registered States

C-level Roles and who occupies them

and much more…

These files are massive and messy. A single form submission can grow up to 100 pages. I found this on data on Thursday and have been slowly modeling the form data into a database I can query against.

Next week I plan to have a deep dive on this data to share with you.

The importance of this find can’t be understated. I now have 40k highly quantified leads and all the certification-holding employees I would target for sales messaging. This was a huge step forward and a fortuitous sign from the capitalism gods.

Carveouts

It’s spooky month, and so it’s time for autumn lofi!

I’ve been going through the backlog of videos from Secret Base, which is a shoot-off of SB Nation. I wasn’t familiar with SB Nation, but I love this content. Deep dives on sports history from a statistical lens. It makes sports nerdy for me which I need to enjoy it hahah.

Finally, I cannot recommend Understanding Michael Porter enough. It’s the best book on positive sum business strategy and thinking. Michael Porter is the GOAT and is heavily misunderstood by kids who were bored in college. This book changed my entire perspective on how to look for product opportunities.

Put some respect on Porter’s name and dig in. If you do, let me know what you think!