Fractal Prospecting

Building our niche discovery engine

Howdy friends! I hope you’ve had a beautiful week!

Welcome back to the Infinite Playground.

This week: Market exploration and sales prospecting

Note: I’m going to start splitting this up into two sections, one on a concept I’ve been mulling over (if any) and one that’s a more accountability-focused update.

Fractal Prospecting

The goal of Tetra is to find and build in simple, niche, and dominatable markets. We believe that finding these niches is not a matter of “earned industry secrets” but a solvable problem of legibility and adjacency.

First, you have to know a niche exists. Then you have to notice the problem. That’s all an “earned industry secret” is. They “earned” a perspective to notice an issue. Anyone could’ve seen the problem if they “earned” that adjacency to the problem. Think about this like building a surface area of luck, or exposure to problems.

This idea is at the heart of the Tetra services strategy. Companies are human organizations with repeatable problems - sales operations, data infrastructure, etc - where we can build competence. We can aim that competence at small, niche, dominatable markets and put ourselves adjacent to new problems. We’ll seize those problems and use the distribution channels we’ve built selling our services to sell our new product. Rinse, repeat, and compound.

How do you start to build machinery for finding niches? How do you find markets you’ve never been exposed to, serving problems you’ve never had?

I call this the Legibility Problem. The method I’ve come up with I’ve started calling Fractal Prospecting.

Start with a buyer. We’re lucky that most companies have similar structures, and that humans advertise what they do on LinkedIn. Look at your past companies. Find a buyer you’ve seen many times. Ask them what tools they use. If you’re a buyer, start with the tools you used that were your “system of record”. For sales, that’s your CRM. For engineering, that’s your servers. For data folks, that’s your data lake or warehouse.

You start with a blank slate of problems a buyer is confronting.

At first, none of their problems are legible.

You need to find the system of record. Systems of record carry a lot of weight in an ecosystem. They are the signal of a market’s existence. Every major function in a company has a system of record for their work. Very often, they’re the largest companies in a given market, because they grow to represent some fraction of the entire market itself.

You start by exploring what is most obvious to you. The largest system of record companies and their competitors. These are the 10,000lb gorillas in the room, they should be easier to find.

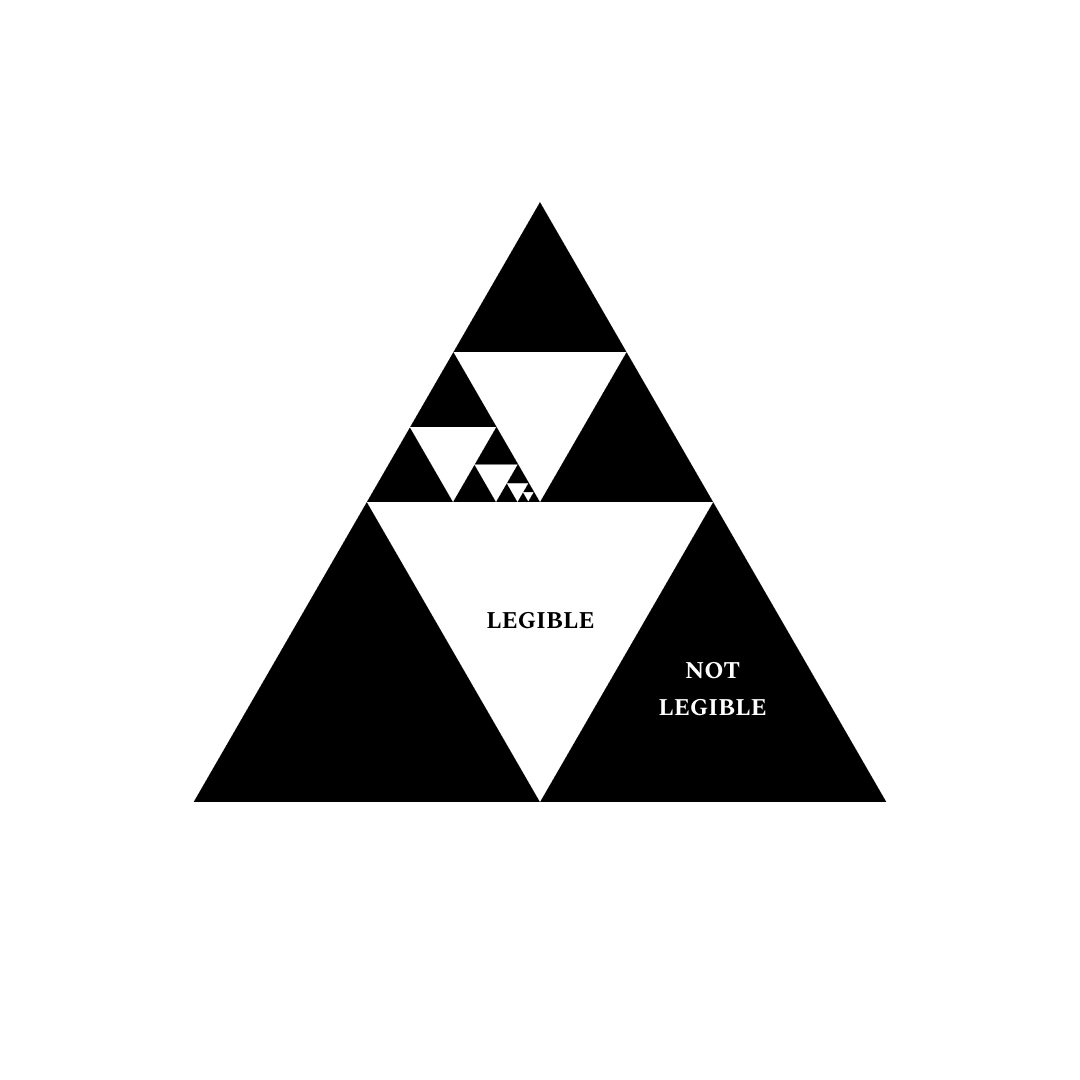

It’s clear these companies do not represent the whole market, but a significant chunk. They carry the gravity at the center of this ecosystem. You now have a jumping-off point. Part of the market has become legible to you. In the diagram above, the largest white triangle has been found.

You may find a specific feature is described with an acronym. Google that acronym and you’re sure to find an entire sub-ecosystem whose entire business is solving that problem for a variety of other niches. Your context grows, but you’ve been introduced to more sub-ecosystems. There is now a web of new competitors, new customers, and new related markets to dive into.

It’s overwhelming. Each step of the way you uncover more details that lead to another, seemingly smaller niche that is also populated by billion-dollar companies.

At the same time, you know you’re missing things. Your methods will have gaps due to perspective bias. Competitors to the company you’re researching will slip through the cracks. For every white triangle you uncover leaves a black triangle in its wake. Maybe they were just founded, or haven’t announced investor rounds. Maybe they are bootstrapped. Maybe their SEO is terrible. Worst of all, the algorithms you’re relying on for your search - Google, Crunchbase, LinkedIn, etc - may not prioritize them in results for reasons beyond our understanding.

Your goal is to find the end of this fractal pattern. You want to find a market small enough that you can find all of its members. You’ll feel this happening. Each search you do will start to return less surprising results. The same names will pop up over and over again in marketing materials. You’ll find one new company in every search instead of 10. When the surprises have stopped, you’ve reached the end.

That’s a niche. A niche is a market you can bear hug.

I’ve started to think about this problem as a large fractal tree. Each market - say, sales tools - is a tree in the forest of the world economy. The trunk splits into branches. Large branches lead to smaller branches, which lead to leaves. Each of these segments is smaller in turn and represents the same thing as the white triangles in the previous image. This is a more pleasant analogy. I’m looking for a leaf on a tree, not fumbling around blindfolded in a maze of never-ending submarkets.

The problem is much easier now that you’re bear-hugging a niche market leaf. The entire forest, with its 8 billion people, interconnected roots, and branch systems is messy. You’ve now narrowed your problem down to a few thousand people working in the space. They’re building and selling the same kind of products, either in direct competition or to specific verticals. They probably have a lot of the same problems.

Selling is a game of empathy. Your knowledge and empathy will compound as you sell to each of these companies from the same leaf much faster than taking a horizontal cut of a larger market. Given the proximity of the leaves, I also believe anything done on a given branch compounds to the rest of the surrounding leaves.

Think about it like this - an SDR selling semiconductors has very different day-to-day pain points than an SDR selling Notion. The genre of their pains is the same. Rejection-filled work. They have to fill quotas, blah blah blah. But if I show up to sell to the revenue operations team of the semiconductor company and I know their specific pain points, I develop trust a lot faster than if the last folks I talked to sold Notion.

I think this focus will also pay dividends in writing marketing copy. I can get into a single headspace and think about a very specific set of buyers or readers.

This Week At Tetra

I spent this week fully focused on prospecting.

In the future, this will become a regular part of a larger sales motion. But for now, it’s a new discipline for me - and a grueling one! I wanted to sit down, get familiar with the pain, and grind through it.

Within each day I’ve taken to focusing only on a single output. I’ve found this easier to do than running in a few separate directions and multitasking. In my head I try to imagine myself as a specific tool, doing only one thing well and with full attention.

That focus comes with the fear that I’m not doing “enough”. That’s a natural fear to have when moving only in one set direction per day. A lot of things are being ignored in favor of compounding on a single task. In these moments I think about a stream of water eroding a rock. The more focused my attention, the faster the water, the faster the erosion. Under that eroded rock, a lesson.

Big analogy and metaphor week for me hahah. Fractals. Trees. Tools. Erosion.

Prospecting and Quantification

I’ve broken my prospecting work into four distinct stages.

Discovery - the fractal prospecting described above

Quantification - low fidelity research to get basic data: Company size, offering, fundraising history

Qualification - high fidelity research: familiarizing myself with offerings, reading blogs, mapping organization structure around buyers, and gauging revenue by researching customers.

Engagement - sales pipeline formally begins

Stages 1 and 2 are completely separated. This allows me to focus entirely on finding companies and finding branches and leaves. Then separately I can come back and build a list of priorities out of trends I’ve noticed in offerings, size, fundraising, and offerings.

Stages 3 and 4 will be contiguous. I’ll qualify in batches and then engage with those batches while their information is still fresh in my mind.

Numbers Game

My goal for 2024 is to have replaced my salary from Barracuda, $120k, with an additional 30% net profit margin. That’s $156k in revenue. My goal for the rest of Q4 2023 is to cover my rent for the quarter.

Sales is a human game on an individual deal level. But it’s a statistical game in aggregate. If you’re selling against a real pain in a large enough market, someone will buy what you’re selling.

I don’t expect my sales pipeline to be efficient to start with. The average sales pipeline converts ~2.6% of sales prospects to closed deals. I’ve planned for 0.5%.

Let’s say I expect my average engagement to be $5k. I need to close an average of 2.6 deals per month. That’s 200 prospects for every closed deal. 520 prospects per month. Finally, I factor in a worst-case 90-day lead time for those prospects to close.

By October next year, I need to have found 6240 prospects and engaged with all of them. Whew!

I don’t expect things to go this poorly, but it’s nice to plan around a worst-case scenario and be surprised. At the very least, I want to build an engine that is capable of organically mapping 6,000+ companies per year. Even if we don’t engage with all of them, we can still grow our understanding of the legible universe!

First Steps

I started by looking at the portfolios of Barracuda’s investors. These firms all focused on early-stage companies. I know the pains of early-stage companies well. It’s as logical as a starting place as any.

100 companies survived my filters. I’m looking for products I understand, that are generating real revenue, and are building something I would want to be pitched on. A problem arose pretty quickly here - there was no underlying thesis for these investments. They were easily legible - most funds list their portfolios - but the signal was weak. There was no return on my learnings by looking at these very disparate companies.

I took a look through VC firms that invest with a tighter focus. You would be surprised by often these funds abandon their thesis, or stretch it beyond its stated theme.

This is where I started to think about the Legibility Problem.

After mulling this problem over, I went to an area I know well - data warehouses.

I dug in specifically on Snowflake. I found their partners program, which returned ~110 prospects. Through that research, I found the Snowflake Summit and its sponsors. From this page alone I found another ~150 prospects.

These combined prospects fill out what I’ve called a “cohort”, or +200 prospects. I’m thinking about my sales outbound in the same way I’d measure new users in a product. I expect my base rate of 0.5% throughput for this first cohort. The cohort system will give me a way of measuring the effectiveness of different sales, marketing, and prospecting strategies.

From the ~260 leads I had found, I targeted the ETL category next. ETLs/ELTs/rETLs are data pipelines between systems of record and data lakes or warehouses. If you’re using Snowflake or one of their competitors, you’re also using an ETL product - or you’ve built your own. ETLs felt like a niche market leaf. I was right. I found ~75 additional prospects in the ETL space. These companies sold ETL solutions, or ETLs were a major part of their product suite.

One week. 440 prospects discovered and quantified. 75% on the same fractal tree.

Next week I’ll start qualifying and engaging the ETL folks. Prospecting additional leaves and expanding the backlog will be a daily activity, but only for an hour or so.

Some takeaways from qualification:

Twitter is functionally useless for highly technical B2B SaaS products. The largest companies in the data infrastructure market have hundreds of thousands of followers, 500 views per tweet, and 1 like. There is some alpha there if you can crack it, but I mostly saw a lot of wasted marketing salaries.

Dollars fundraised and the number of rounds have very little correlation with company size. I’ve seen Series E, F, G, and H companies in the data infrastructure space with 500 or less employees. Either there are a lot of hidden costs, or their capital efficiency and customer lock-in are next-level. We’ll see more soon.

After a certain size, every company starts to have very well-organized case studies, white papers, and marketing content. On the smaller end of the scale, startups with well-organized marketing content seem to be able to communicate their problem more easily. That ability to communicate their problem seems analogous to early PMF, which you can see in their fundraising history.

The more an early-stage company uses “next generation” the more you can bet they’re a small team with no marketers and are probably pre-PMF. If they had PMF they would be able to describe their product concretely.

That all said, it is very surprising how incomprehensible some products are, even after spending 50 hours reading blogs and landing pages about their competitors.

Many of these data infra companies have glossaries in their marketing resources. Just a full page of dictionary definitions! If your potential buyers are willing to read a dictionary to understand your product, their pain is (1) very real (2) more painful than reading dictionary definitions (3) very high value.

Carveouts

I’ve gone full monk mode and hidden away my PC, Xbox, and PlayStation in the guest bedroom’s closet. Consequently, I’ve gotten a lot more reading done!

Books I’ve been reading on sales:

Fanatical Prospecting - covers how prospects are different than leads (leads show buying interest) and reinforces the grueling but necessary nature of prospecting.

Predictable Revenue - a sales playbook from the guy who got SalesForce to $100m in revenue. Very useful for quick references and frameworks. My main takeaway was the different types of customer acquisition - seeds, spears, and nets.

SPIN Selling (thanks Sam) - very analytic research that fits well with my engineering brain. Focuses on longer-term, high-value sales and breaks a lot of common myths proliferated in sales books written for low-value products.

Large Account Sales - same as Spin Selling, but focused on enterprise sales techniques.

Books I’ve read:

Churchill, Paul Johnson

Napoleon, Paul Johnson

I found both of these books on my shelf while reorganizing. Johnson does a great job of condensing down all the details from several hundred-page biographies and telling that same story in a more thrilling way in 200 pages or less. I cannot recommend these books highly enough.