Introducing: Tetra Research

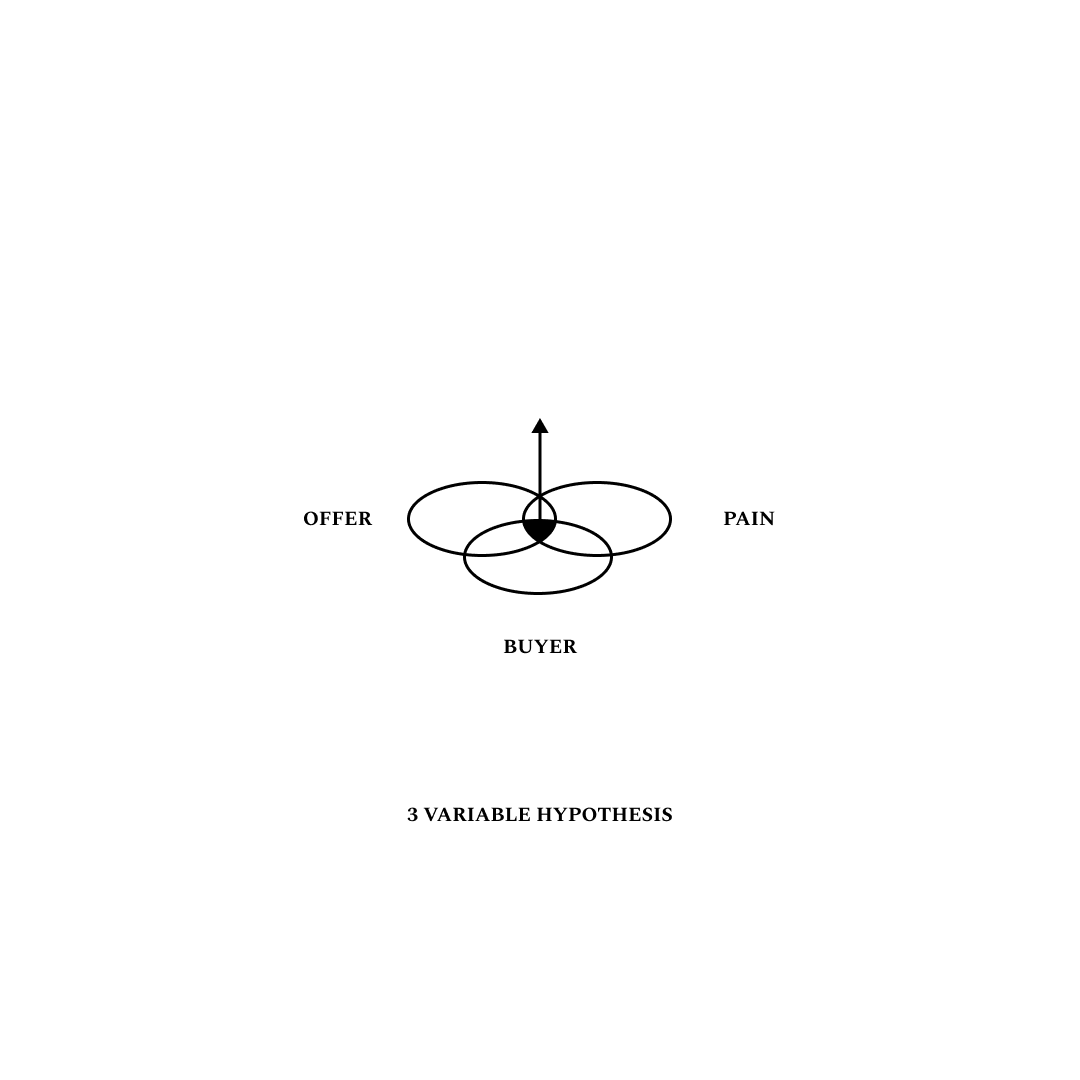

Entering the Infinite Playground

Howdy friends!

I’ve started a new company! It’s called Tetra Research. Tetra for short.

This newsletter, Infinite Playground, is named after one of the core concepts that led me to start Tetra. I’ll use this platform to send out semi-regular updates on the company, how the strategy is evolving, and what we’re experimenting with.

I have no goals for growing this newsletter, but you’re welcome to share. My intent is to have a place to capture all the ideas I want to talk about with folks I trust. I’d love to see that community expand over time, but sharing and accountability is my end goal.

I’m actively experimenting with a new writing style where I storyboard my ideas in Figma and then expand on them in Substack. I’ve also fallen in love with using footnotes. If you have any thoughts on the final product or the visualizations below, please let me know!

The idea for Tetra was born from a simple place.

In the past, I’ve made many career decisions that were driven by ambition, and I let my curiosity, creativity, and craftsmanship serve that ambition.

I’m changing course.

I want to refocus my life and career around curiosity, creativity, and craftsmanship. I want my ambition to serve those means.

I want to build things that are meaningful to me and valuable to others.

And I want to build a company to enable others to do the same.

“Meaningful to me and valuable to others” is a large problem space. I’ve taken to calling that space my “Infinite Playground”. Life is short. I want to spend the rest of my time here with you all pushing the limits of our craft, being of service to others, and doing meaningful work that feels like play.

The ultimate goal of Tetra Research is to build a vehicle to explore the Infinite Playground.

I want to align economics and craft. What follows is my current strategy and philosophy for doing so.

I want Tetra to embody simplicity.

Simplicity should echo through everything we do. Our product offerings. Our organizational structure. Our strategy1, logo2 and name3.

No more frontier markets. No more VC rocket fuel.

I wanted to run my next company like I'd run a laundromat in my hometown or any other non-software business.

To me, that means:

Capital efficiency supported by high hurdle rates and a tight strike zone

An extremely long-term perspective

A religious belief in compounding

Tetra Research is a bootstrapped permanent equity vehicle ($10 words for a holding company). Permanent is the keyword.

Our timeline is infinite. Our goal is simple and continuous: build capital-efficient compound growth machines to enable great products and services.

We'll hold these companies until they run their course.

An infinite timeline gives you room to breathe. It allows you to compound not only profits and cash flow but also lessons and ideas. We can play in the same markets for many years with many ideas. There is no pressure on an individual idea to grow to a billion-dollar market cap and IPO - simply to exist, serve customers, and grow steadily and with the very healthy profit margins software enables.

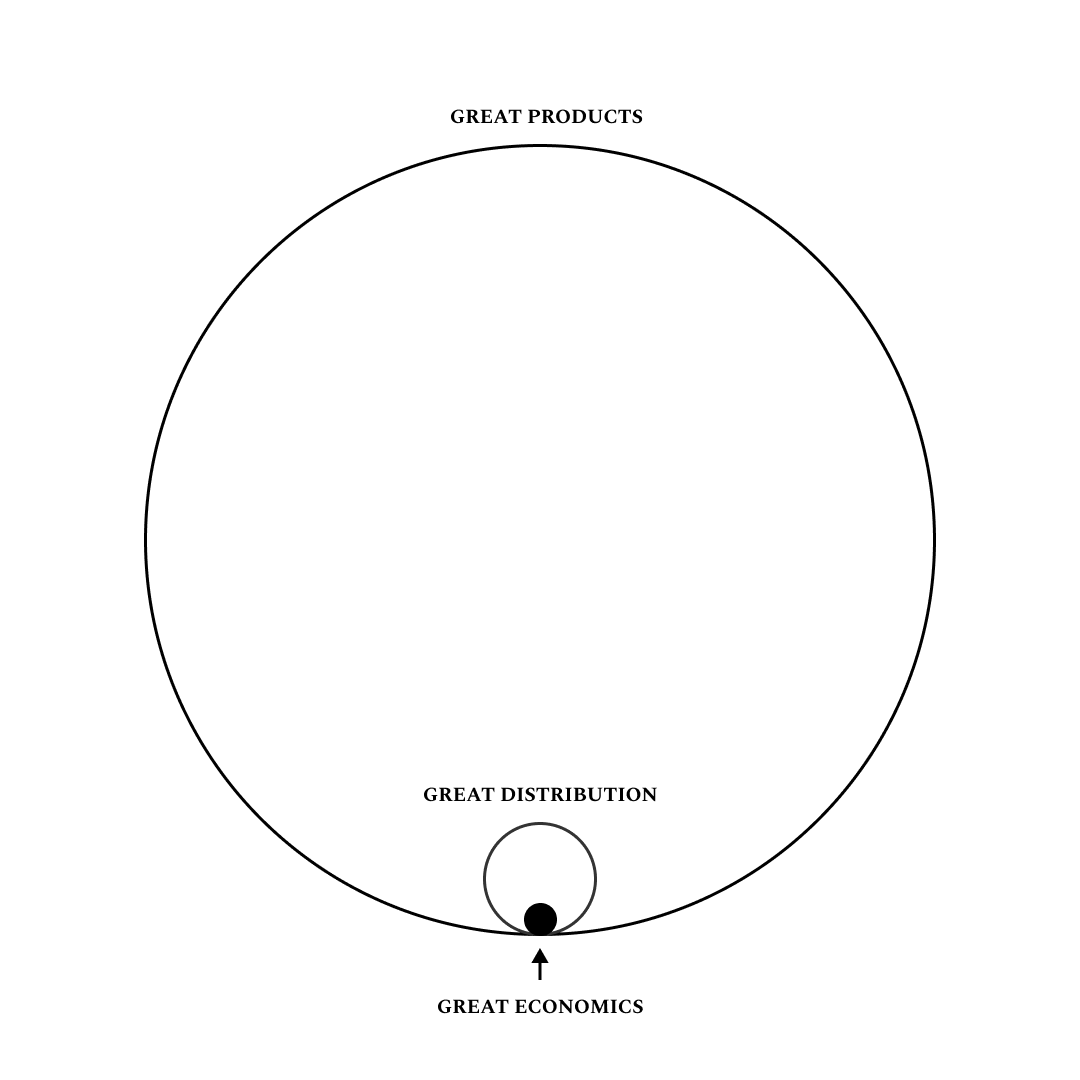

We believe that great products are enabled by great economics and distribution.

No more exploratory markets or products. No free tiers. "Burn rate" is not in the Tetra dictionary.

We want to use our craft where it counts. We find demand and we build craftsmen products. We’ll sell those products profitably and hone that profitable edge over many years.

Great distribution means there is a clear and explicit pain felt by a known buyer with a budget allocated to that pain.

This is our jumping-off point for experimentation.

We keep our hypotheses simple. Damn simple. Simplicity keeps you close to reality.

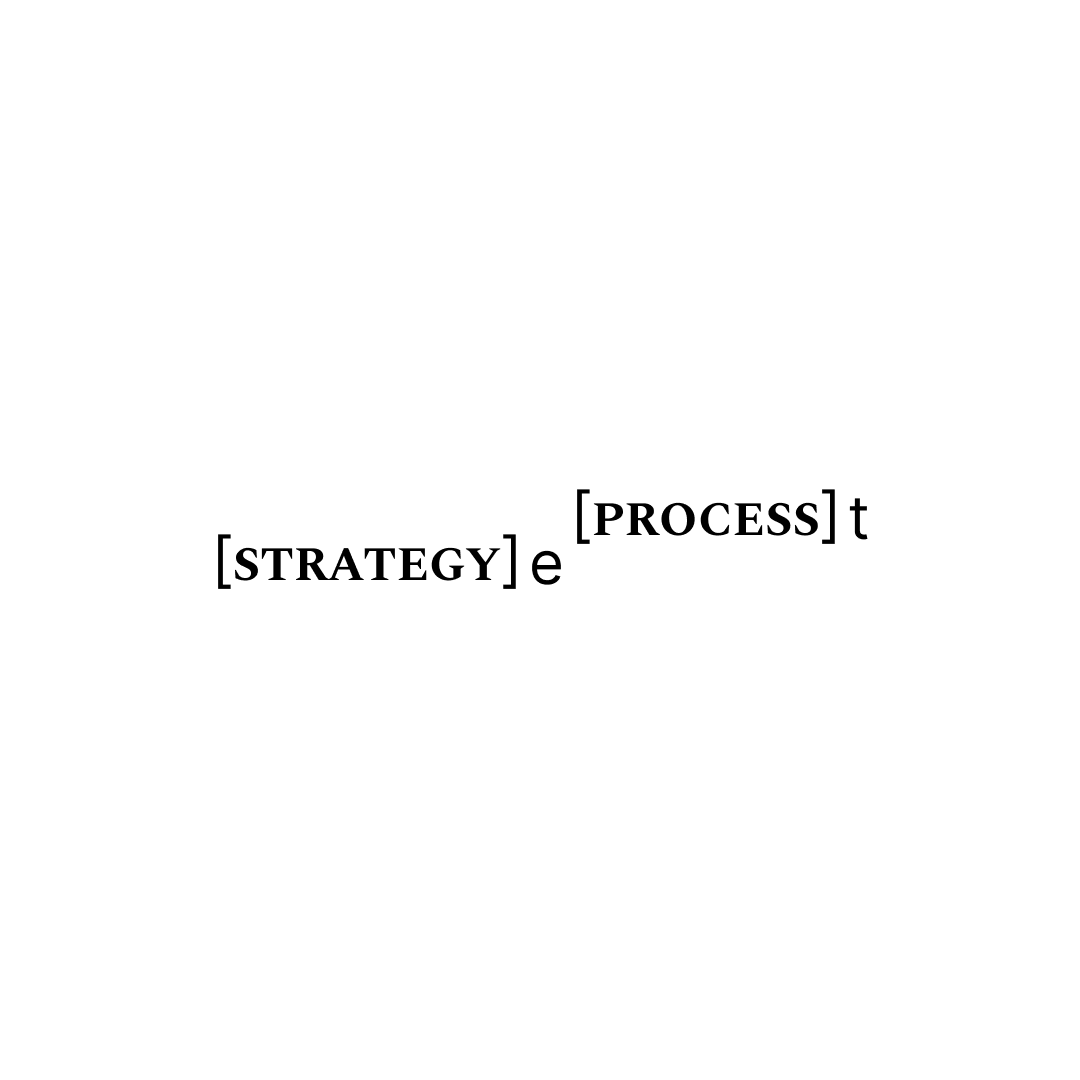

Each offering has three components:

A clearly articulated buyer with a budget at +100k companies

A hypothesis of a pain, found through research or service work

A hypothesis of a solution to that pain

If we can't explain the pain, solution, and value prop in a single sentence, it's out of our strike zone4. If it doesn’t turn a profit within the next 3-6 months, we don’t swing.

Our aspirations are humbler.

We do not need complex markets and billion-dollar outcomes. We’re happy with 20% profit margins on a $10m niche market growing at a steady rate for the next ten years.

When you think about compounding cash flow over a lifetime, you can also think about compounding smaller successes and victories together.

We want simple niches that we can dominate.

But niche does not mean shallow.

Software is not done eating the world. The last two decades were an appetizer.

We have a fundamental belief that there are still unexplored depths in most market niches - for products AND services.

We’re starting with productized services.

Our encompassing thesis is that services expand your surface area for noticing painful problems that you can solve with great products. Services open the door.

My definition of a productized service is freelance or consulting work where:

The price of the offering is disconnected from hourly rates. You charge fixed fees, upfront, based on the return on investment profile of the project for the customer.5

The scope of work can be sold like a product. Instead of buying a SaaS product, you’re buying a specific process and an ongoing relationship.

Depending on the nature of the scope of work, a monthly retainer could be paid to provide the same value prop over a long period, replacing a full-time hire for the same role.

I’ll have more specifics in the coming weeks, but here are some of the ideas I’m working through now:

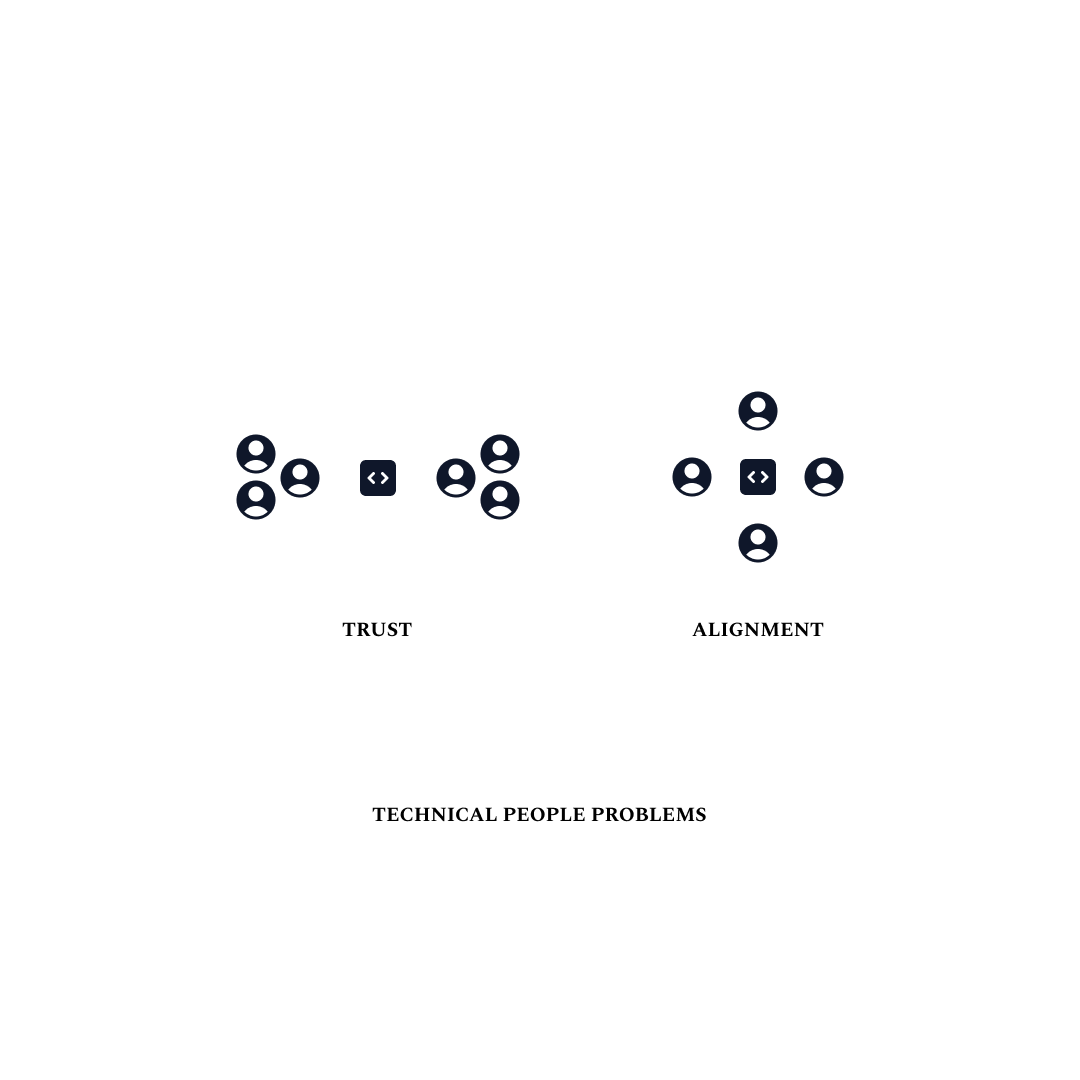

Technical Audits. There is a large market of non-technical founders who outsource their product development instead of hiring for it directly. I’ve found time and time again that this is an environment ripe with trust issues. There is room for services that help vet and audit outsourced work to build confidence. This same problem exists for non-technical acquirers of technical products on platforms like MicroAcquire.

Engineering Interview Problems. The job market for software engineers is under a lot of pressure right now as engineers write LLM tools to automatically apply for jobs and rewrite their resumes for specific opportunities. Traditional engineering interviews and take-home problems can be solved with GPT and do not provide any signal. Good technical leaders also want to know that engineers are capable of fully leveraging LLMs moving forward, and need problems specifically built to measure that. There is a market for building custom interview problems specific to these companies and their work to help them get more hiring signals out of all the noise.

Building data infrastructure. Every startup needs to start building its data infrastructure once it hits its Series A and starts approaching its Series B. This normally requires hiring an analyst and dedicating valuable engineering time to building data pipelines. This is a prime target for a productized service that brings in outside engineers to build your data stack and rebuild analytics in a more sustainable tool like Tableau or Looker.

CX and Sales automations. Another resource misalignment problem.

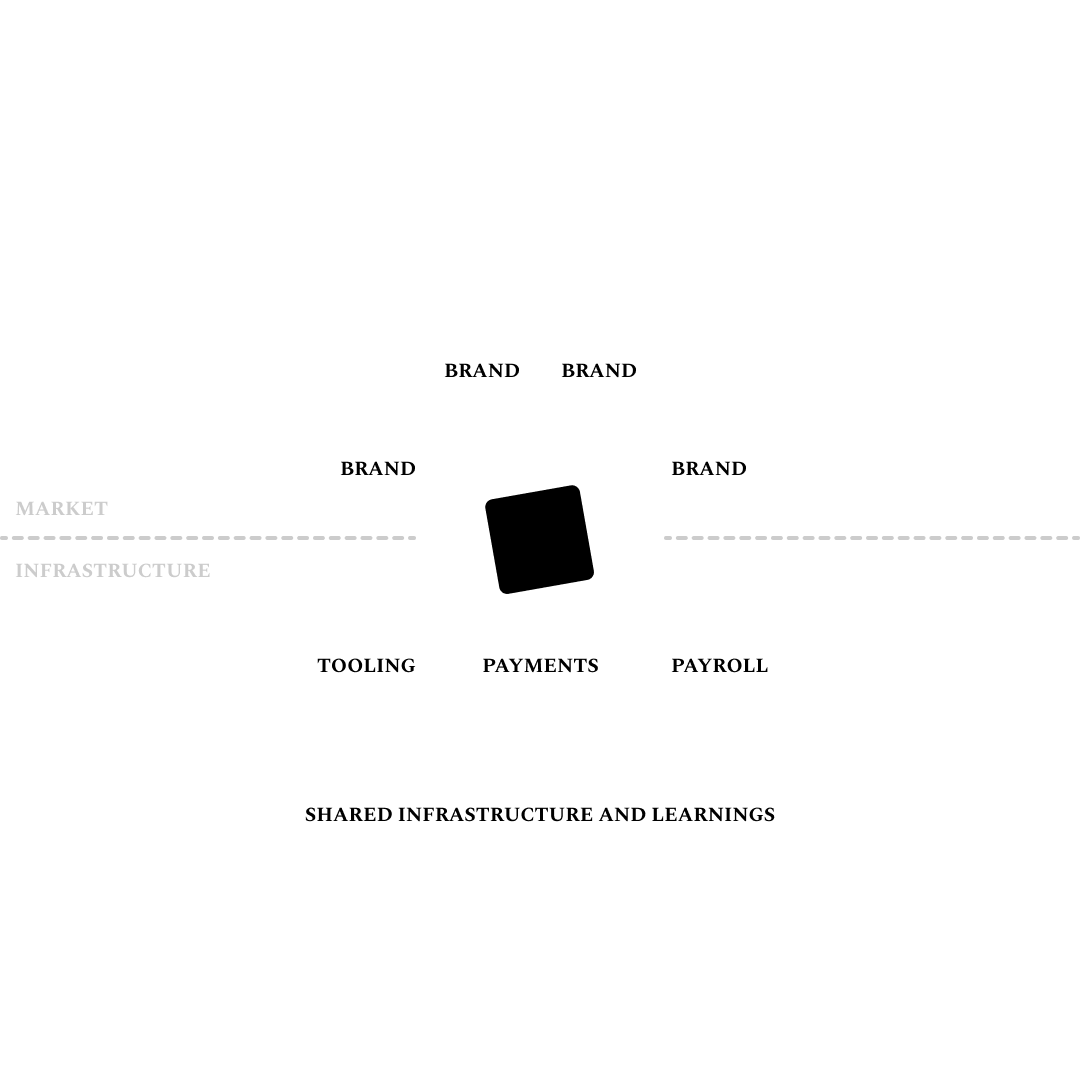

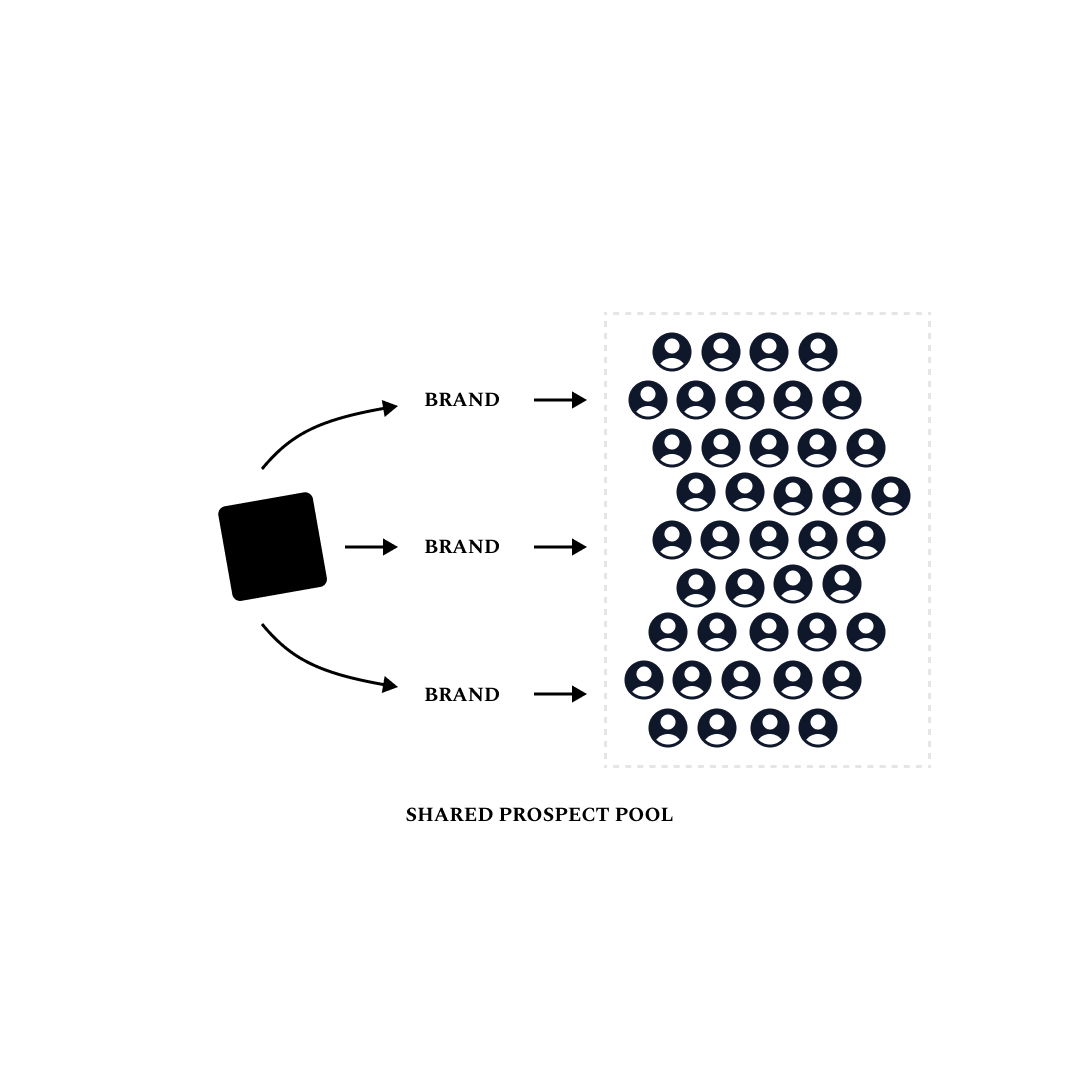

Tetra will create and launch brands that will share a lot of the same infrastructure. Where possible, tools will be consolidated.

Brands will live independently of Tetra. We want customers to build relationships with teams working on their problems, not Tetra.

There is an understated advantage to the multi-brand model: we can reuse the prospect pool for very different offerings.

This is a hidden economy of scale that you can use as a canvas for new offerings.

A prospect may not be good for Brand A but will be for Brand B. As we grow, we compound this prospect base and our understanding of these companies. With that new understanding, I can interpolate what Brand C might be.

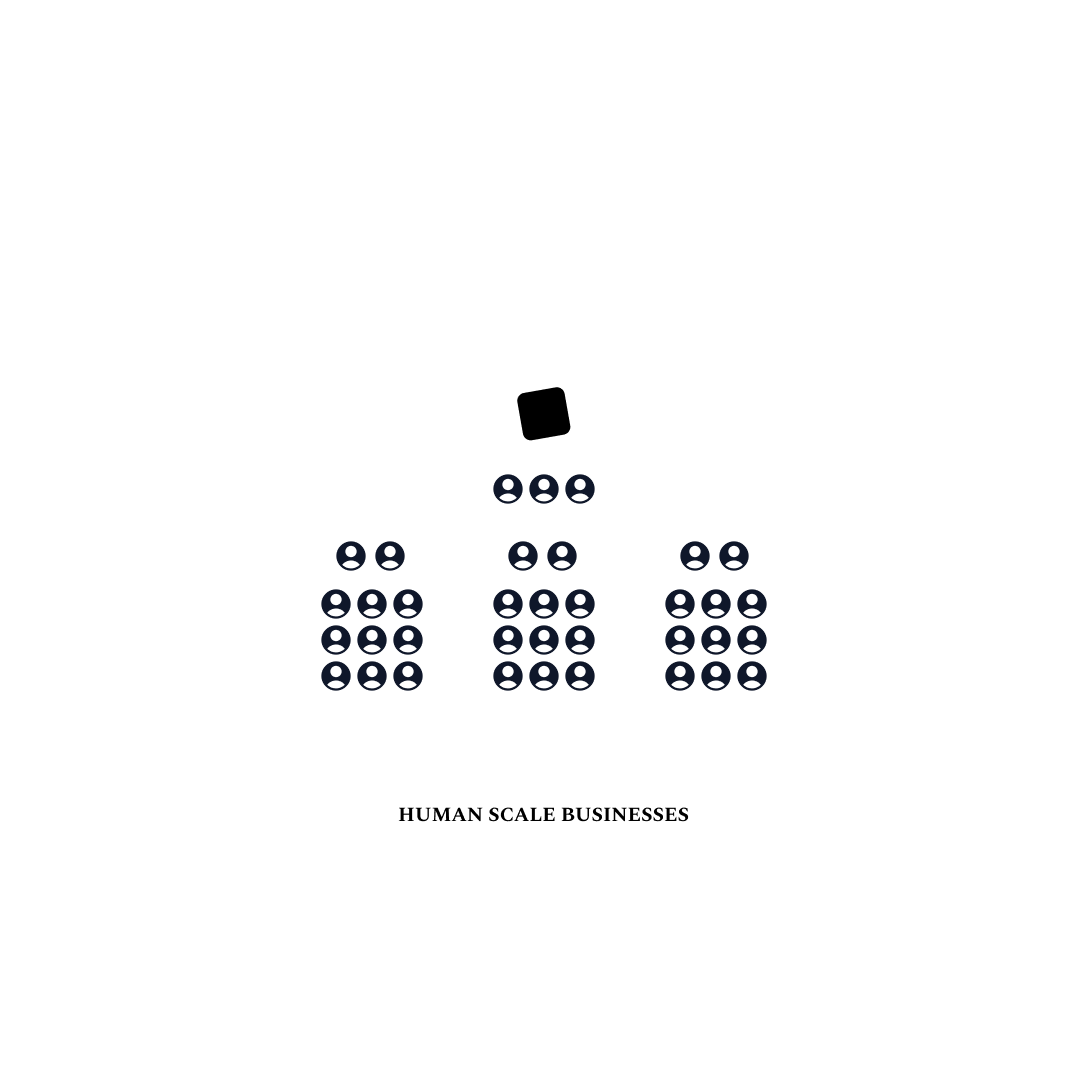

I've seen firsthand what a lethal small team can accomplish when properly aligned and given room to run. Our teams will remain small. I want to build Tetra to be a platform for great partners to do their work, with a trusting and decentralized structure.

Each brand will run independently. The “home office” will be as small as possible, and only responsible for capital allocation. I don’t want to lead this company with an iron fist, I want to guide towards opportunity and let great builders loose.

But right now it's just me! No cofounders or outside capital. The goal is to start small and find what works out on the field.

Everything above is aspirational, now I have to go build.

Thanks for reading!

I’ll write to you again soon when my first ideas have solidified and I’ve started selling. That should be next week.

I’ve edited out several thousand words from this post about the origin of Tetra’s strategy and its inspiration. Then I discovered footnotes :)

In my head, I see Tetra as a generative form of Constellation Software. We have a different approach to seizing the same business model. Eventually, this will be a blog post of its own.

Constellation is a Canadian private equity roll-up fund run by Mark Leonard. They buy vertical market SaaS businesses with a specific profile:

$1-$10m revenue

in niche industries - think software for paper manufacturers or pool supply companies

+20% net profit margins over a meaningful period

+20% YoY growth over a meaningful period

They take these +20% profit margins into the holding company, Constellation, as free cash flow. Then Constellation is free to reinvest that cash into growing existing businesses or acquiring new ones. Constellation started in 1995 and has compounded its initial $25m at a rate of over 30% per year ever since. Their current market cap is $43.8b.

I’ve found a few companies with a similar structure to Constellation that served as inspiration for Tetra. Both are video game companies: Supercell, the makers of Clash of Clans, and Paradox Interactive, the makers of some of my favorite grand strategy games.

Both of them have extremely high hit rates for their games. Supercell in particular is known for its robust experimentation process and a high kill rate for new projects. But when a project gets traction it explodes.

Paradox is a little different. They have a definitive style of games they produce and publish and they've honed the development cycle for that genre. Even though their games cover very different topics, they're all on the same general thesis of game style, so they can roll learned lessons from one project into the next super easily.

In both cases, their games are much more like SaaS products than regular games. They are supported for several years with continuous updates and paid DLC that give them cash flow.

The idea for the square logo came from the logo of Foundations Worldwide, Inc., which is proudly displayed on baby changing stations around Kansas City. Their logo is simply a circle next to their name. It stuck in my head for a long time.

If you know me personally you’ll know I’m a very symbolic person. I care a lot about names and other iconography a group rallies behind. Whenever Barracuda would pivot or I’d change product lines at MainStreet, I’d change my Slack themes and code editor to embrace the new headspace.

The real origin story for the name Tetra is that I heard it in the Tetris movie. Tetra means four in some ancient language or another. I liked how Tetra felt on the page and the rest was history.

Alternative stories I might use in the future:

Neon Tetra is a small freshwater South American fish. After my time at Barracuda, and now alone in my next venture, a small fish seemed thematically appropriate.

Tetra means four, and this is my fourth major project (depending on how you count)

I’m sure I’ll improv many more in the coming years.

A side benefit of these simple hypotheses is how straightforward content becomes to write. Write to the buyer. If you’re selling a service, write whitepapers they can download that explain everything you do. If you’re selling a product, write case studies on the direct metrics those buyers generally track across the industry. Interview those buyers for a podcast. Write guides for surrounding products and how to use them well. The content writes itself and will easily fill automated email marketing campaigns.

Fixed fees align incentives. You start selling results and not time. The fixed-rate shares the risk of the project going over time or ballooning in scope. You, the seller of the service, only benefit if you can complete the work in a profitable time horizon. The buyer of the service caps their downside risk. This builds more trust in the relationship and kills a lot of overhead from tracking hours. In the long run, it allows you to build a more boutique and expensive brand where your price is far disconnected from your hourly cost.